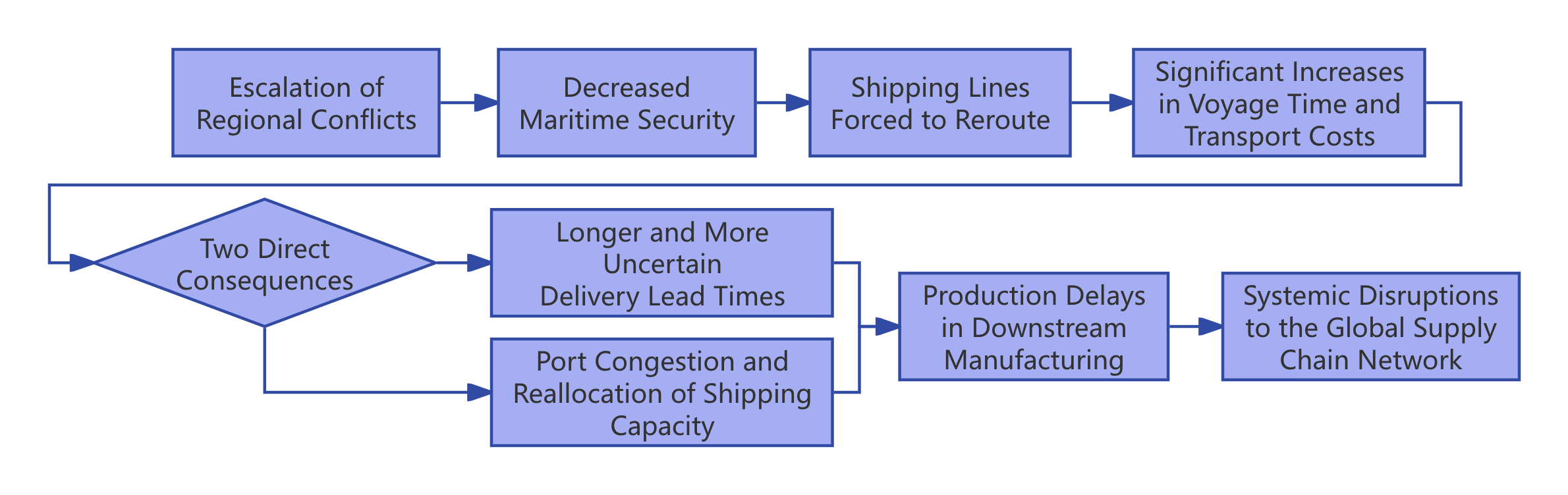

Entering the third decade of the 21st century, global supply chains reveal considerable systemic vulnerabilities due to the cumulative effects of pandemic disruptions, geopolitical conflicts, and recurrent extreme weather phenomena. Conventional supply chain models focused on cost efficiency and lean operations encounter ongoing difficulties. This study establishes a comprehensive framework for evaluating global supply chain hazards from a multidimensional risk viewpoint, incorporating political, economic, and natural concerns. It methodically examines the initiating mechanisms, transmission routes, and interconnected impacts of each risk category. The study provides a streamlined risk assessment methodology that equips organizations with actionable analytical tools, including an indicator system and a multidimensional risk matrix, to ascertain risk exposure levels and comprehend risk structures. This study formulates a supply-chain resilience strategy system tailored for complex and uncertain situations, which is based on four essential dimensions: structural robustness, process adaptability, information-driven capability, and collaborative governance. The research demonstrates that by recognizing risks from various dimensions and integrating conceptual quantitative assessment tools, enterprises can more efficiently pinpoint critical vulnerabilities, improve supply chain resilience, and bolster their shock resistance and enduring competitive advantage in high-uncertainty contexts.