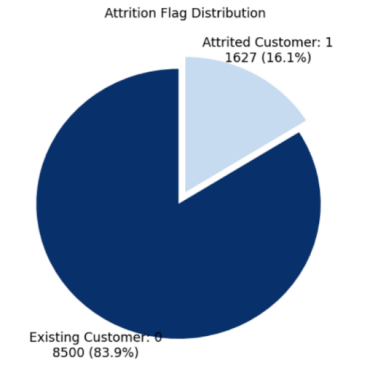

The study proposes a machine learning framework that optimizes the approval processes of Neo Banks loan applications and overcomes the limitations of traditional credit scoring models. Using feature engineering, ensemble methods, and hyperparameter optimization on customer demographics, financials, and transaction details to determine loan acceptance. The results show that the improved models have the accuracy of 97.87% and 88.59% recall and are far better compared to traditional methods (logistic regression: 63.76% recall). Significant predictors are education level (importance: 0.35), income (0.30), and family size, with the probability of approval among high-income, high-education customers being 45% higher. The framework reduces the false negative rate, allowing the Neo Banks to focus on the cream of the crop applicants but avoiding risks. Examples of practical strategies are customized marketing and dynamic pricing. This work talks about limitations such as data imbalance, and future research suggests integrating real-time behavioral data and fairness-aware modeling. It fills a gap between tech innovation and operational requirements, providing a scalable method for updating credit risk evaluation in digital banking.

Research Article

Open Access