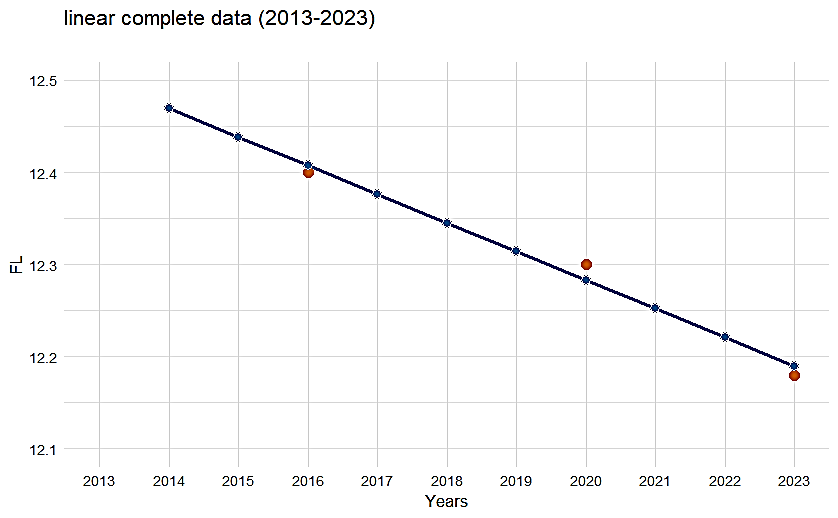

Global internet companies commonly face the paradox of high growth coupled with persistent losses, with financing strategy as the key solution. This paper uses Pinduoduo as a single case study to analyze the changes and impact of its financing strategies before and after IPO. Findings reveal: Pre-IPO, via three private equity rounds and Tencent’s support, Pinduoduo established a “capital and resources” model, validating its “social group-buying and low-price” strategy and achieving a $12.5 billion pre-IPO valuation. During IPO, Pinduoduo avoid underperformance at discount, and used an AB share structure to balance financing and control, with minority shareholder disputes. Post-IPO, Pinduoduo shifted to diversified financing to support Temu and supply chain upgrades. Financially, it shifted from losses in 2018 to profitability in 2023, capturing a large proportion of the sinking market. Pinduoduo’s divergence from Alibaba (debt financing) and JD.com (asset-heavy equity financing) stems from its business model and cash flow dynamics. This study offers insights for high-growth enterprises, however, due to single-case limitation, the conclusions' universality needs further validation.

Research Article

Open Access