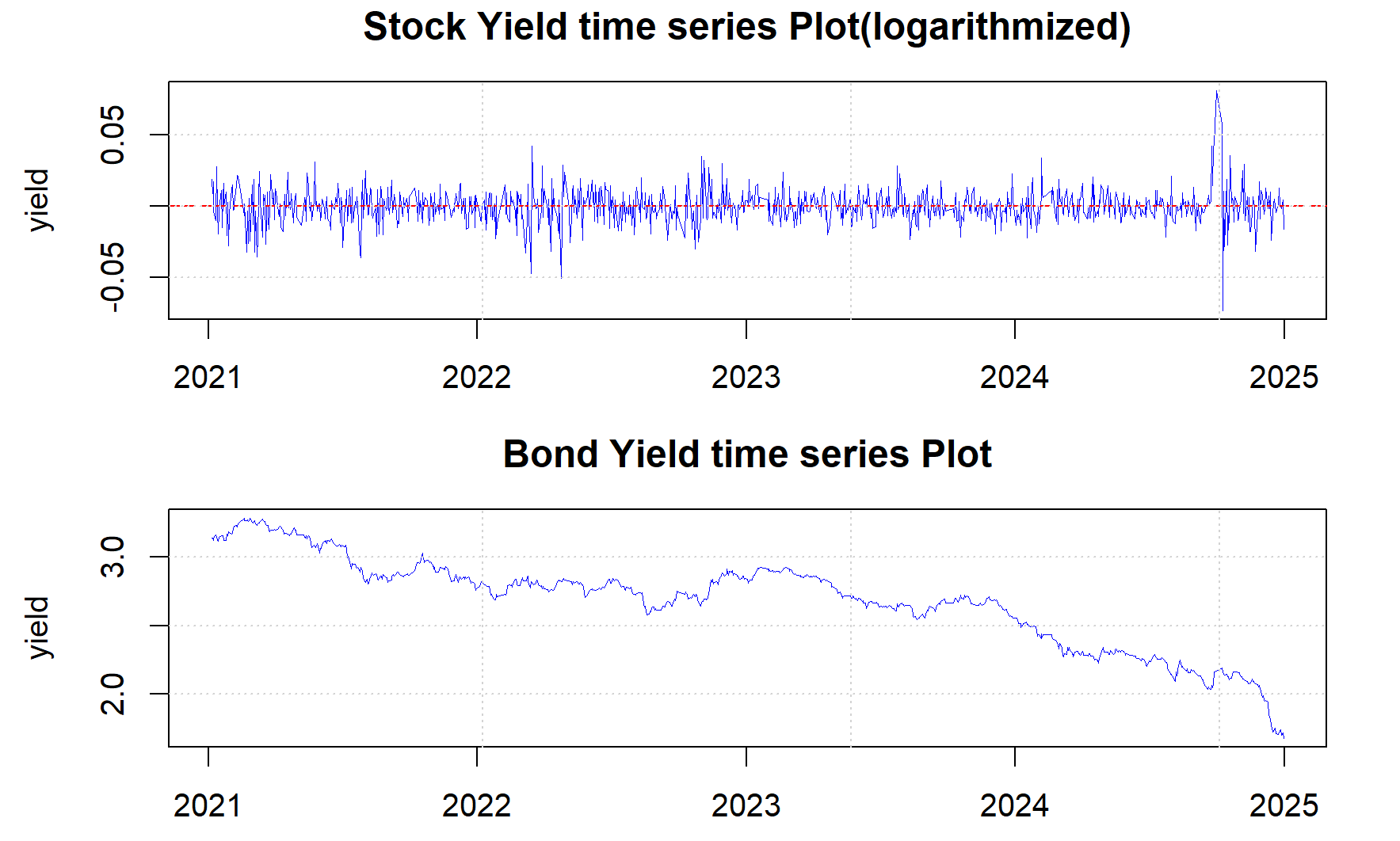

The objective of this study is to examine the predictive relationship between the China stock market and the bond market. With the worsening economic environment entering 2024-2025, the stock-bond linkage mechanism has played an increasingly important role in financial forecasts. But through the current forecasts, it has been noticed that the forecasts often ignore the systematic connection of market information between the markets. The construction of the model was focused on a VAR model with the return of the stock market as an exogenous variable, which was contrasted with the traditional ARIMA model, and the nature of the connection between the two markets was evaluated through Granger causality test, variance decompositions, and impulse responses. The outcome of the test showed the superiority of the VAR model in terms of the key predictive accuracy of the forecast, especially regarding the declining trend of the bond market yields. Overall, the findings suggest that the stock market exhibits significant leading and explanatory power over the bond market, indicating that integrating cross-market information can enhance forecasting accuracy and provide more effective quantitative support for asset allocation and risk early warning by leveraging leading indicators from the stock market.