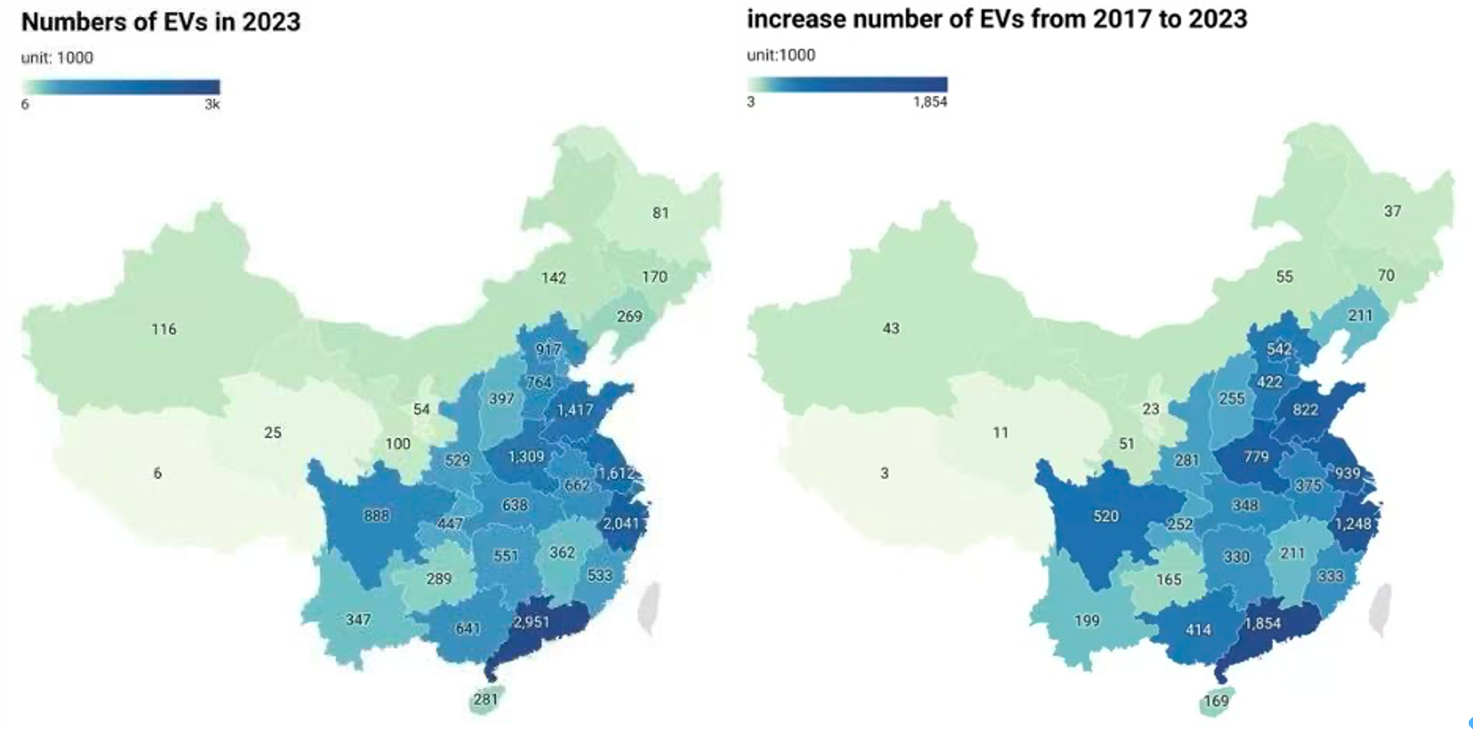

Significant variations in electric vehicle (EV) deployment exist across China. To inform policy for more balanced EV deployment, this paper performs a nationwide analysis to explore influential factors associated with EV deployment. This paper uses a comprehensive province-level dataset covering 2017-2023 on EV stock, charging infrastructure, province-level demographics and economics, and policies, and the author uses a comprehensive multi-model framework (linear, regularized, and machine learning models) that the author validates using cross-validation. Charging infrastructure density, education level, and urbanization rate are the most consistent predictors of EV deployment; Random Forest achieves the best performance in prediction, and policies and economics show limited explanatory variation. Therefore, to achieve a more balanced deployment of EVs, policymakers should focus on investments in charging infrastructure and stations, increasing public understanding of sustainable technologies, and incorporating EV deployment into urban planning, as infrastructure and socio-demographic fundamentals are more explanatory than pure economic or policy measures.