About AEMPSThe proceedings series Advances in Economics, Management and Political Sciences (AEMPS) is an international peer-reviewed open access series that publishes conference proceedings from a wide variety of methodological and disciplinary perspectives concerning economic and management issues. AEMPS is published irregularly. The series welcomes empirical and theoretical articles concerning micro, meso, and macro phenomena. Proceedings that are suitable for publication in the AEMPS cover domains on various perspectives of economics, management and political sciences and their impact on individuals, businesses and society. |

| Aims & scope of AEMPS are: · Economics · Management · Political Sciences |

Article processing charge

A one-time Article Processing Charge (APC) of 450 USD (US Dollars) applies to papers accepted after peer review. excluding taxes.

Open access policy

This is an open access journal which means that all content is freely available without charge to the user or his/her institution. (CC BY 4.0 license).

Your rights

These licenses afford authors copyright while enabling the public to reuse and adapt the content.

Peer-review process

Our blind and multi-reviewer process ensures that all articles are rigorously evaluated based on their intellectual merit and contribution to the field.

Editors View full editorial board

London, UK

canh.dang@kcl.ac.uk

Leeds, UK

S.Amini@lubs.leeds.ac.uk

Cardiff, UK

EshraghiA@cardiff.ac.uk

London, UK

alexandre.loktionov@kcl.ac.uk

Latest articles View all articles

Based on Bourdieu's 'capital-field-habitus’ theoretical framework, this paper conducts a secondary analysis of three empirical studies in the Chinese educational context to illustrate how family cultural capital influences students' academic performance through academic habitus. The results show that there is a stable positive relationship between family cultural capital and academic performance, which is not mainly achieved in a direct way, but through the formation of habitus habits that are consistent with the school assessment rules, which are further manifested in sustained learning behaviours, and finally transformed into academic strengths. In the test score-centred Chinese educational environment, learning habits play a key mediating role in the transformation of cultural capital into academic performance, and the differences in the intensity of the role in different studies are related to differences in educational stages and research designs, and reflect the process by which the educational evaluation mechanism and the structure of learning practices jointly influence the path of capital transformation.

View pdf

View pdf

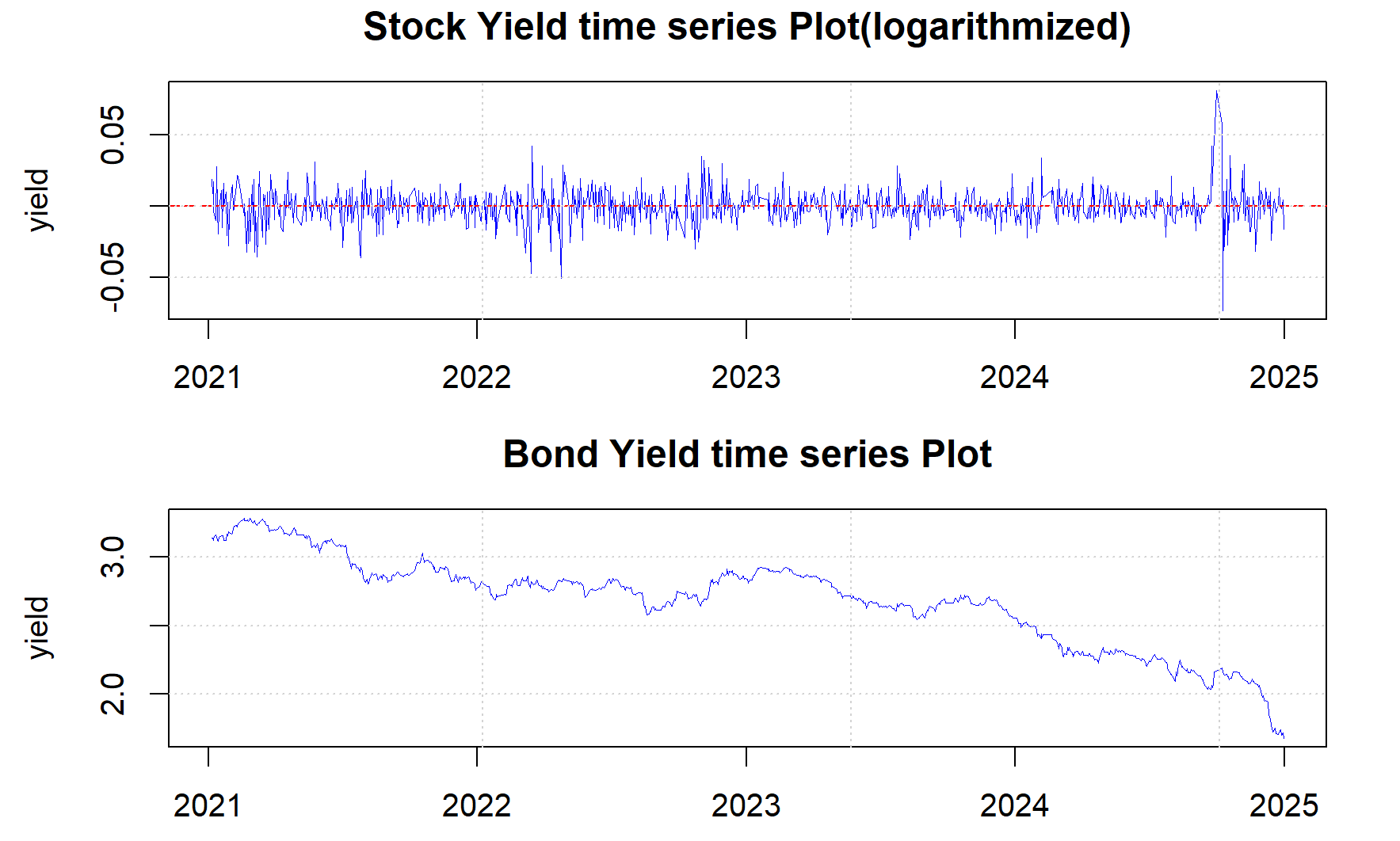

The objective of this study is to examine the predictive relationship between the China stock market and the bond market. With the worsening economic environment entering 2024-2025, the stock-bond linkage mechanism has played an increasingly important role in financial forecasts. But through the current forecasts, it has been noticed that the forecasts often ignore the systematic connection of market information between the markets. The construction of the model was focused on a VAR model with the return of the stock market as an exogenous variable, which was contrasted with the traditional ARIMA model, and the nature of the connection between the two markets was evaluated through Granger causality test, variance decompositions, and impulse responses. The outcome of the test showed the superiority of the VAR model in terms of the key predictive accuracy of the forecast, especially regarding the declining trend of the bond market yields. Overall, the findings suggest that the stock market exhibits significant leading and explanatory power over the bond market, indicating that integrating cross-market information can enhance forecasting accuracy and provide more effective quantitative support for asset allocation and risk early warning by leveraging leading indicators from the stock market.

View pdf

View pdf

With the continuous development of logistics and online shopping, Cainiao Station, as the last link of the logistics system and an important facility for convenient public services, is gaining increasing importance in urban daily life and industrial development. However, it still has some obvious problems that seriously affect its operational efficiency. This paper uses the methods of ergonomics, facility planning and operations research to analyze the existing problems from the aspects of distribution efficiency, station location design, spatial layout and utilization rate, and user pick-up experience, and puts forward feasible solutions one by one, so as to improve the operational efficiency of the station and the user pick-up experience. Finally, by observing the common problems and operational status of some Cainiao Stations and combining the actual situations of different stations, this paper proposes a set of universally applicable and highly practical optimization templates to improve the operational efficiency and customer satisfaction of Cainiao Station.

View pdf

View pdf

This paper aims to explore the current status and emerging trends of corporate supply chain management within the context of intelligent supply chains by conducting a comparative analysis of the supply chain systems employed by three typical high-tech enterprises, namely Apple, Xiaomi, and Huawei. Adopting a case analysis method, the study systematically examines the theoretical foundations of intelligent supply chains while providing a detailed analysis of the distinctive features and strategic approaches that characterize the supply chain management practices of these three corporations. The findings indicate that Apple has significantly enhanced production efficiency and reduced inventory by implementing a global outsourcing strategy and building an agile and efficient supply chain network. Huawei has remarkably improved operational efficiency and market competitiveness by focusing on digital and intelligent upgrades and constructing a high-end supply chain system integrating intelligent procurement, manufacturing and logistics. Xiaomi has achieved rapid market response and cost control by adopting a hybrid and agile collaborative supply chain model based on ecological cooperation and digital empowerment. The study concluded that the evolution of intelligent supply chains presents both unprecedented opportunities and challenges for corporate supply chain management.

View pdf

View pdf

Volumes View all volumes

Volume 263March 2026

Find articlesProceedings of ICMRED 2026 Symposium: The Future of Work: Strategy, Workforce Transformation, and Organizational Renewal

Conference website: https://www.icmred.org/London/Home.html

Conference date: 10 April 2026

ISBN: 978-1-80590-679-7(Print)/978-1-80590-680-3(Online)

Editor: An Nguyen , Lukáš Vartiak

Volume 262March 2026

Find articlesProceedings of ICMRED 2026 Symposium: Financial Innovation, Risk Governance, and the Dynamics of Global Capital Flows

Conference website: https://www.icmred.org/Bratislava/Home.html

Conference date: 8 June 2026

ISBN: 978-1-80590-675-9(Print)/978-1-80590-676-6(Online)

Editor: Lukas Vartiak

Volume 261March 2026

Find articlesProceedings of CONF-BPS 2026 Symposium: GenAI, Labour Markets, and the Economics of Human and Financial Capital

Conference website: https://www.confbps.org/London.html

Conference date: 19 February 2026

ISBN: 978-1-80590-651-3(Print)/978-1-80590-652-0(Online)

Editor: Canh Thien Dang

Volume 260March 2026

Find articlesProceedings of CONF-BPS 2026 Symposium: Innovation, Finance, and Governance for Sustainable Global Growth

Conference website: https://www.confbps.org/Beijing.html

Conference date: 5 March 2026

ISBN: 978-1-80590-649-0(Print)/978-1-80590-650-6(Online)

Editor: Canh Thien Dang , Li Chai

Announcements View all announcements

Advances in Economics, Management and Political Sciences

We pledge to our journal community:

We're committed: we put diversity and inclusion at the heart of our activities...

Advances in Economics, Management and Political Sciences

The statements, opinions and data contained in the journal Advances in Economics, Management and Political Sciences (AEMPS) are solely those of the individual authors and contributors...

Indexing

The published articles will be submitted to following databases below: